In the modern financial landscape, borrowing money has become an integral part of personal and business planning. Whether you need funds for an emergency, a major purchase, or to grow your business, the question of where to get a loan often arises. Two of the most common options are banks and microfinance organizations (MFOs). Each has its own advantages and disadvantages, and the choice between them depends on your specific needs, financial situation, and goals. This article explores the key differences between banks and microfinance organizations, helping you determine where it is more profitable to get a loan.

Understanding the Basics: Banks vs. Microfinance Organizations

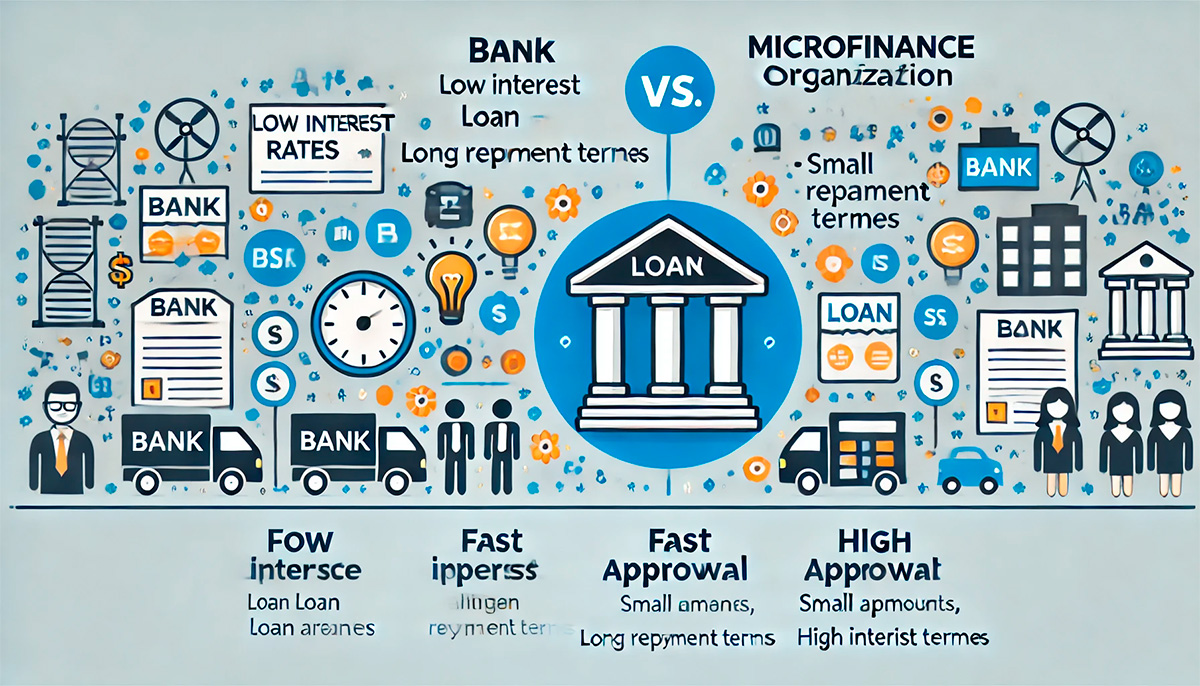

Banks are traditional financial institutions that offer a wide range of services, including savings accounts, credit cards, and loans. They are typically regulated by national or regional authorities, ensuring a high level of security and reliability. Banks are known for offering lower interest rates on loans compared to other lenders, but they also have stricter eligibility criteria and longer approval processes.

Microfinance organizations, on the other hand, are smaller institutions that specialize in providing small loans to individuals and businesses, often in underserved or rural areas. MFOs are known for their flexibility and accessibility, making them a popular choice for those who may not qualify for a bank loan. However, this convenience often comes at a cost, as MFOs typically charge higher interest rates than banks.

Interest Rates and Fees

One of the most significant factors to consider when choosing between a bank and a microfinance organization is the cost of borrowing. Banks generally offer lower interest rates on loans, especially for individuals with good credit scores and stable incomes. For example, a personal loan from a bank might have an annual interest rate of 10-15%, depending on the borrower’s creditworthiness and the loan term.

Microfinance organizations, however, often charge significantly higher interest rates, sometimes exceeding 30% annually. This is because MFOs take on higher risks by lending to individuals with poor credit histories or irregular incomes. Additionally, MFOs may impose various fees, such as processing fees or late payment penalties, which can further increase the overall cost of the loan.

Eligibility and Approval Process

Banks have stringent eligibility criteria, requiring borrowers to provide extensive documentation, including proof of income, credit history, and collateral for larger loans. This can make it difficult for individuals with poor credit scores or irregular incomes to qualify for a bank loan. The approval process can also be time-consuming, often taking several days or even weeks.

Microfinance organizations, by contrast, are much more lenient in their eligibility requirements. They often require minimal documentation and may not even check the borrower’s credit history. This makes MFOs an attractive option for those who need quick access to funds. The approval process is typically faster, with some MFOs disbursing loans within a few hours or days of application.

Loan Amounts and Terms

Banks usually offer larger loan amounts compared to microfinance organizations. For instance, a bank might provide a personal loan of up to $50,000 or more, depending on the borrower’s financial profile. Banks also offer longer repayment terms, which can range from a few months to several years. This makes banks a better option for those who need substantial funds and prefer to repay the loan over an extended period.

Microfinance organizations, however, specialize in smaller loan amounts, often ranging from a few hundred to a few thousand dollars. The repayment terms are also shorter, typically lasting a few months. While this can be beneficial for those who need a small amount of money quickly, it may not be suitable for individuals or businesses requiring larger sums or longer repayment periods.

| Criteria | Banks | Microfinance Organizations |

|---|---|---|

| Interest Rates | Lower (10-15% annually) | Higher (often exceeding 30% annually) |

| Eligibility | Strict (requires good credit score, proof of income, and collateral) | Lenient (minimal documentation, no credit check) |

| Approval Time | Longer (several days to weeks) | Faster (a few hours to days) |

| Loan Amounts | Larger (up to $50,000 or more) | Smaller (a few hundred to a few thousand dollars) |

| Repayment Terms | Longer (months to years) | Shorter (a few months) |

Risk and Security

Banks are generally considered safer and more secure than microfinance organizations. They are subject to strict regulatory oversight, which ensures that they adhere to ethical lending practices and protect borrowers’ interests. Additionally, banks often offer insurance and other financial products that can provide added security for borrowers.

Microfinance organizations, while regulated, may not always offer the same level of security. Some MFOs operate in less regulated environments, which can increase the risk of predatory lending practices. Borrowers should exercise caution and thoroughly research any MFO before taking out a loan.

Flexibility and Customer Service

Microfinance organizations are often praised for their flexibility and customer-centric approach. They are more willing to work with borrowers who have unique financial situations, offering customized repayment plans and other accommodations. This can be particularly beneficial for individuals who have been turned down by banks or who need a more personalized lending experience.

Banks, while reliable, may not always offer the same level of flexibility. Their processes are often more rigid, and they may be less willing to negotiate loan terms. However, banks do provide a higher level of customer service, with dedicated relationship managers and comprehensive support systems.

Conclusion: Which Option Is More Profitable?

The decision of where to get a loan—whether from a bank or a microfinance organization—depends on your specific needs and circumstances. If you have a good credit score, require a larger loan amount, and prefer lower interest rates, a bank is likely the more profitable option. On the other hand, if you need quick access to a smaller amount of money and have less-than-perfect credit, a microfinance organization may be the better choice.

Ultimately, it is essential to carefully evaluate your financial situation, compare the terms and conditions of different lenders, and choose the option that best aligns with your goals. By doing so, you can ensure that your borrowing experience is both profitable and stress-free.

Whether you choose a bank or a microfinance organization, remember that responsible borrowing is key to maintaining your financial health. Always read the fine print, understand the terms of the loan, and ensure that you can comfortably meet the repayment obligations. With the right approach, you can make an informed decision and achieve your financial objectives.