Buying a home is one of the most significant financial decisions a family can make. However, rising property prices and stringent lending criteria can make it challenging for many families to secure a traditional mortgage. This is where a family mortgage comes into play. A family mortgage is a unique financing option designed to help families purchase a home by leveraging the financial strength of multiple family members. This article explores what a family mortgage is, how it works, and who can qualify for it.

Understanding Family Mortgages

A family mortgage, also known as a family pledge mortgage or family-assisted mortgage, is a home loan that allows multiple family members to combine their incomes, assets, or creditworthiness to qualify for a larger loan amount or better terms. This type of mortgage is particularly beneficial for first-time homebuyers, young families, or those with limited credit history who may not qualify for a traditional mortgage on their own.

In a family mortgage, the primary borrower (usually the person purchasing the home) can include the income, savings, or credit of other family members, such as parents, siblings, or even grandparents, to strengthen the loan application. This collaborative approach not only increases the chances of approval but also helps secure more favorable interest rates and terms.

How Does a Family Mortgage Work?

Family mortgages operate differently depending on the lender and the specific program. The general process involves a joint application where the primary borrower and supporting family members submit their financial details together. This allows the lender to consider the combined income, assets, and credit scores of all applicants when evaluating the loan.

All parties listed on the mortgage application share responsibility for repaying the loan. This means that if the primary borrower defaults, the supporting family members are equally liable for the debt. Family mortgages often come with flexible terms, such as lower down payment requirements, extended repayment periods, or reduced interest rates. These features make homeownership more accessible for families who might otherwise struggle to qualify for a traditional mortgage.

In some cases, the supporting family members may have a stake in the property. This means they are entitled to a share of the home’s equity, which can be beneficial if the property appreciates in value over time.

Who Can Qualify for a Family Mortgage?

Family mortgages are designed to be inclusive, but they do have specific eligibility criteria. The primary borrower, typically the person purchasing the home, must meet the lender’s basic requirements, such as a minimum credit score and stable income. Supporting family members, who contribute to the mortgage, must have a strong financial profile, including good credit scores and sufficient income or assets.

Lenders typically require that supporting family members be immediate relatives, such as parents, siblings, or grandparents. The home being purchased must also meet the lender’s criteria, such as being a primary residence and not an investment property.

| Eligibility Criteria | Description |

|---|---|

| Primary Borrower | The person purchasing the home must meet the lender’s basic requirements, such as a minimum credit score and stable income. |

| Supporting Family Members | Family members contributing to the mortgage must have a strong financial profile, including good credit scores and sufficient income or assets. |

| Relationship Requirements | Lenders typically require that supporting family members be immediate relatives, such as parents, siblings, or grandparents. |

| Property Type | The home being purchased must meet the lender’s criteria, such as being a primary residence and not an investment property. |

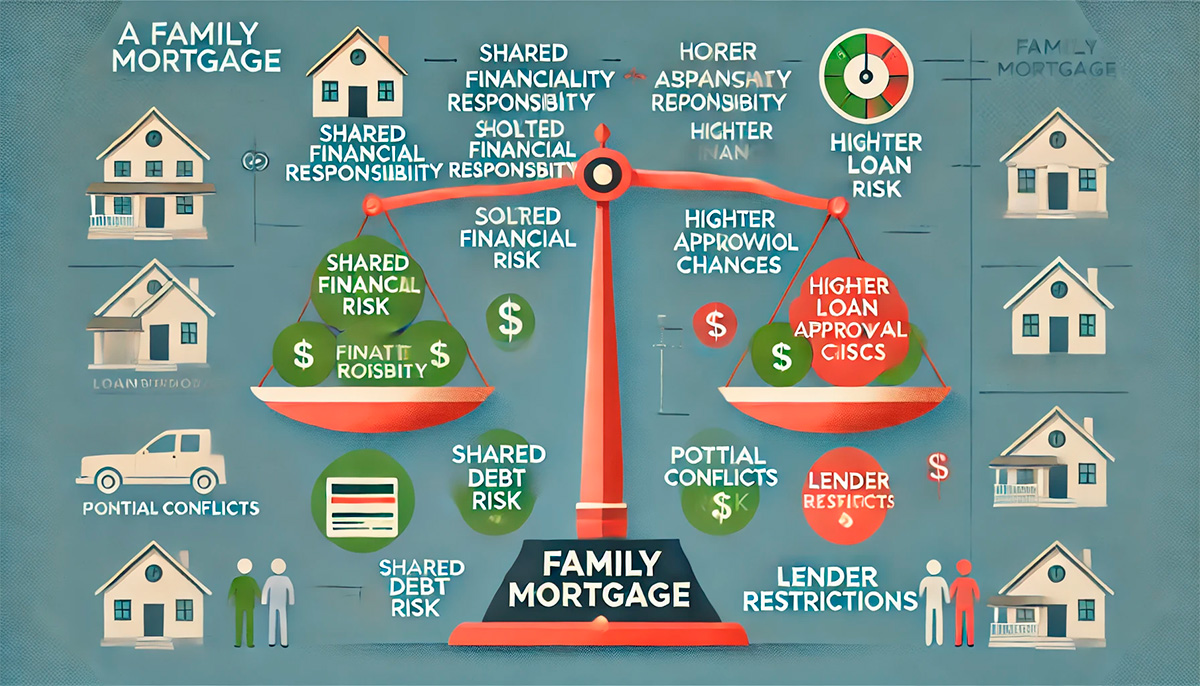

Benefits of a Family Mortgage

Family mortgages offer several advantages for both the primary borrower and the supporting family members. By combining incomes and assets, families can qualify for a larger loan amount, making it possible to purchase a more expensive home or secure a better location. Many family mortgage programs require a lower down payment compared to traditional mortgages, reducing the upfront cost of homeownership.

Including family members with strong credit scores can help secure a lower interest rate, saving thousands of dollars over the life of the loan. With multiple family members contributing to the mortgage payments, the financial burden is distributed, making it easier to manage monthly expenses.

Potential Challenges of a Family Mortgage

While family mortgages offer many benefits, they also come with potential challenges that should be carefully considered. All parties listed on the mortgage are equally responsible for repaying the loan. If the primary borrower defaults, the supporting family members may face financial consequences. Mixing family and finances can sometimes lead to conflicts, especially if there are disagreements about payments or property ownership.

Not all lenders offer family mortgage programs, and those that do may have strict eligibility criteria or limited loan options. It’s essential to weigh these challenges against the benefits and ensure that all parties are comfortable with the shared responsibility.

How to Apply for a Family Mortgage

If you’re considering a family mortgage, start by researching lenders that offer family mortgage programs and compare their terms, interest rates, and eligibility requirements. Prepare all necessary documents, including proof of income, credit reports, and identification for both the primary borrower and supporting family members.

Consulting a financial advisor can help you evaluate whether a family mortgage is the right option for your situation and guide you through the application process. Once you’ve gathered all the required information, submit a joint mortgage application with all participating family members. Be prepared to provide additional information or documentation as requested by the lender.

Conclusion: A Path to Homeownership

A family mortgage can be an excellent solution for families looking to achieve homeownership while leveraging the financial strength of their loved ones. By combining incomes, assets, and creditworthiness, families can secure more favorable loan terms and make their dream of owning a home a reality. However, it’s essential to carefully weigh the benefits and challenges and ensure that all parties are comfortable with the shared responsibility.

With proper planning and open communication, a family mortgage can be a powerful tool for building generational wealth and creating a stable foundation for the future. Whether you’re a first-time homebuyer or looking to upgrade to a larger home, a family mortgage may be the key to unlocking your homeownership goals.